How I Save Money Shopping Online With DBS Multi-Currency Account

June 09, 2018Everyone knows how shopping makes us happy, and if you know me well enough you will realize that I do it best online! Why? Firstly, the deals are too good to be true, most of the time even better than buying from physical stores. Secondly, it’s super convenient because I can do it anywhere and anytime. Work have been taking up so much of my time and I don’t really have the luxury to shop as often anymore.

Also, online is where I can shop from various brands around the globe that suit my style. I’m sure you guys will agree that sometimes it’s pretty hard to find certain fashion items here in Singapore, so why not just do my shopping on e-commerce sites?

The major downside for me though is the exchange rate from foreign currencies to SGD as well as the hidden conversion costs. I’m sure you all understand the dilemma of when you think you’re spending this much and then when you receive the monthly statement it’s like, surprise! $$$$!! It can get frustrating at times when you don’t know the conversion fees and sometimes it might turn out to be more expensive than what you thought.

That’s why I turn to the DBS Multi-Currency Account (MCA). This account is perfect for those, like me, who love to shop online for overseas brands and travel frequently.

So what does it do? Well, it gives you access to buy any of the 12 foreign currencies at favourable rates. You can buy it at any time of the day, and they can even send you a FX alert when the rate you’re after is met!

Once you have purchased the currency at your preferred rate, your MCA is funded with the foreign currency you transferred. The MCA is like a savings account for multiple (up to 12) foreign currencies, where you can pay directly for purchases in that particular currency. This way, you no longer have to pay for exorbitant exchange rates or be subjected to any extra FX charges (especially the dreaded double conversion fees) ever again. What a smart way to shop online! Note that Renminbi (CNH) is not available for the direct payment feature.

Of course, when given a chance I jumped on it. I mean any methods to save while I shop is a good one to me! So here are some pictures from my recent online shopping spree and what I’ve got.

I did my shopping on kooding.com, an online website that offers Korean & American style for both guys and girls.

I did my shopping on kooding.com, an online website that offers Korean & American style for both guys and girls.

Top: White casual shirt - US$36.99

Outerwear: Green oversized shirt - US$41.99

Pants: Beige linen pants - US$53.99

In total, I’ve purchased 3 items which initially cost S$178 (their current exchange rate is $1.00 = SGD$1.3384).

With the help of the MCA and DBS Visa Debit Card, the exchange rate is lowered to $1.00 = SGD$1.3 and it only cost $$172.90. Yes, moolah saved! So why the difference in $$$?

As mentioned earlier, by using the MCA, there will not be any conversion charges or any other hidden charges when you shop online anymore. The foreign currencies that were purchased was saved in my MCA and funds were directly debited for my overseas purchases.

Not only that, the MCA also benefits frequent travelers, like myself, as well as investors. Here’s a list of its benefits and features:

● Buy and save currencies at your preferred rate, 24/7

● Receive Foreign Exchange alerts on the rates you want

● No Foreign Exchange conversion rates or extra charges

● Transfer funds overseas at zero or lower fees

● Avoid bulky cash when you travel

● Invest directly in foreign currency products

I enjoy travelling and do so pretty often for work. This account is also an excellent tool for me to utilize on my travels. Using the MCA, I will be able to buy foreign currency at my favorable rates leading up to my trip. With my DBS Visa Debit Card (linked to the MCA), not only can I conveniently pay for my items in their local currency but also at no extra FX fees. Plus, I can also withdraw cash from the local ATMs globally. It is perfect as I don’t like to carry bulky cash overseas simply because it is pretty unsafe to do so.

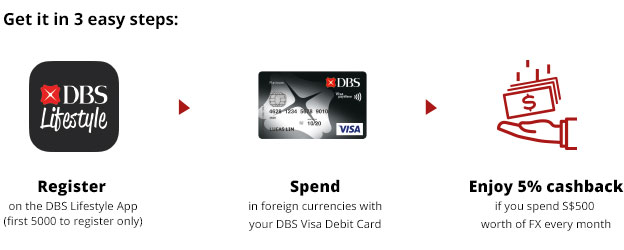

Whether shopping overseas or online, spend in foreign currencies to enjoy 5% cashback with your DBS Multi-Currency Account and DBS Visa Debit Card from 5 June to 31 August 2018!

For anyone looking to invest in foreign markets or purchase shares overseas, you can easily do so with the MCA and DBS Vickers Account. With the help of DBS, you can perform foreign currency trades in up to 7 overseas markets too.

To learn more about the DBS Multi-Currency Account, visit: https://bit.ly/2jNcwmY and you could now also save more money when you shop, travel and invest!

This article is sponsored by DBS, all opinions are of my own.

*Terms & conditions apply. SGD deposits are insured up to S$75k by SDIC.

0 comments